David's Data: Lasco Financial Services - Your Money Store

Hello everyone! Here is the latest installment in the David’s Data series, which is an analysis of Lasco Financial Services Limited. Leave any feedback you have in the comments below or you can send them directly to David at his Twitter account or at our own Twitter or email. Enjoy! - Randy

Lasco Financial Services: Your Money Store

If you want to Buy Money, Sell Money, Receive Money and so much more, you’ll probably think of Lasco Money and its variety of financial products. This is a company which has grown its presence over the years and can be found at the back of the directory covers and be seen on constant TV ads. Today’s analysis will zoom in on another company which has already seen a significant impact from COVID-19.

The company was formed in 2002 under the guidance of founder The Honorable Lascelles Chin who aimed to provide financial solutions to numerous Jamaicans. In 2010, the company was amalgamated and some of the other Lasco companies were brought under the umbrella of LASF which would provide remittance services, cambio services and property management. In that same year, the firm had its IPO where they raised $50 Million and listed with their affiliates on the JSE’s Junior Market. Lascelles Chin remains the largest owner in the listed Lasco companies up to the end of 2019. Since then, they have expanded their balance sheet significantly and done a major acquisition in the form of CrediScotia from Scotia Group Jamaica Limited in late 2017. These activities have lead it to become the number 2 listed company in terms of inbound remittance processing and micro-financing, behind GraceKennedy Limited (Western Union) and Access Financial Services Limited.

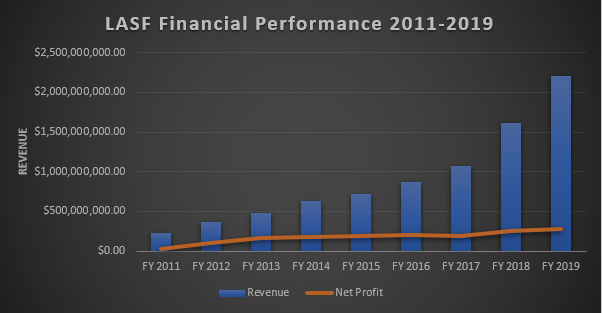

The company has been lead since 2004 by Jacinth Hall-Tracey (Managing Director) who has been supported by a team of 4 key executives and reports to a board of directors comprising of individuals such as Compton Rodney (fellow chartered accountant), Gary Peart (Mayberry Investments Limited CEO) and Vincent Chen (experienced lawyer). This dynamic team has lead the company from revenues of $55.7 Million in 2010 to $2.2 Billion at the end of the 2019 Financial Year (March 31, 2019).

Financial Analysis

Lasco Financial Services (Lasco Money) is a financial services company with 2 wholly owned subsidiaries as of March 2019. The company has grown revenues at a Compounded Annual Growth Rate (CAGR) of 28.79% from 2011 to 2019. The company has expanded its services from the remittance and cambio operations into the payment and loans areas as a way to diversify revenue and try to limit the concentration risk they faced from that segment.

This revenue growth has been driven heavily through promotion of their services and garnering new clients. To this end, they have spent heavily on selling and promotion expenses which have risen from $83.4 Million to $765.6 Million over the same time frame. These expenses have translated to greater revenue growth but have severely dampened the company’s bottom line (net profit). Administrative and other expenses have grown at a similar rate from $103.6 Million to $880.4 Million which can be attributed to the need to process more transactions along with internal structure support for compliance with the Bank of Jamaica (BOJ) regulations and their international remittance partners (MoneyGram and Ria Money Transfer).

The company’s financing costs were steady and remained below $5 Million up to the 2017 FY before ballooning to $168.8 Million in the most recent financial year as a result of the costs associated with their various loans which includes a bond used to acquire CrediScotia.

LASF enjoyed rapid net profit growth between FY 2011 – 2016 when the 100% tax remission resulted in very low or no tax charges to the company. As a result, net profit grew from $29.8 Million to $203.4 Million during this period. However, with a 50% remission in effect since then and high financing costs, net profit has slowed and saw a decline in 2017 to $187.8 Million before climbing to $281.8 Million at the end of 2019. As echoed by MD Hall-Tracey, the greater revenue the company earned, the more it had to spend to achieve that revenue which lead to less being translated to the bottom line.

Remittances

Remittance services has been the core driver of revenue for the company’s revenue. As disclosed in the 2011 and 2018 Annual Reports, remittances made up 65% and 59% respectively of LASF’s total revenue. This comes from the fact that Jamaica receives a significant amount of money from remittances inflows coming from relatives and friends from more developed states such as the United States of America, Canada, United Kingdom and the Cayman Islands. As disclosed from prior gleaner articles and annual reports, their main competitor is Western Union (WU) which is the market leader in remittance companies with approximately half of the market share. However, LASF through its numerous network locations is the biggest MoneyGram processor as disclosed in Annual Reports. Unlike WU which is exclusively to GraceKennedy Limited, MoneyGram also partners with other firms such as Alliance Financial Services and Victoria Mutual Money Services as other remittance providers under an agreement. Thus, for LASF to be the leader in their space is an enticing opportunity for them to capture greater market share in that MoneyGram segment. They also utilize Ria Money Transfer as well to process remittance services for clients who wish to utilize that firm as well.

The company earns money from processing money transfers which are destined for Jamaica (inbound) or destined for another country (outbound). This primary service extends to transferring money from one part of Jamaica to another part for those without bank accounts or aren’t a part of the formal banking system.

Example of a transfer within Jamaica

Cambio Services

As disclosed in their 2011 and 2018 Annual Report, the cambio division contributed 32% and 21% respectively to the overall revenues of the group. Cambio’s make money from the spread which is the difference between what they pay for a currency from a customer and the price they sell it at to another customer. Thus, if they purchase USD from a customer at a rate of $124 and sell it back at a rate of $135, they have made a profit of $11 on the spread between the buying and selling of the currency. Thus, the wider the spread, the greater the profit margin. Apart from selling to Lasco Manufacturing and Lasco Distributors Limited, they also sell foreign currency to numerous retail clients who want to do some form of business with the currency and buy it back from others at a lower rate of exchange. With the need to travel, save and just do business, persons will utilize the services of a cambio to buy at a cheaper rate than the bank and just exchange currency to go do their business as needed.

Microfinance

As disclosed in their 2018 Annual report, microfinance contributed 15% to the revenues of the company. It should also be noted that the subsidiaries contributed $87.1 Million of net profit to the Group (LASF and Lasco Microfinance) which recorded $281.8 Million in net profit. This segment has mainly grown due to the acquisition of CrediScotia and combination of their prior lending division to create Lasco Microfinance Limited. The main way the company earns from this division is through loans to personal consumers and collecting interest off those loans. Unlike commercial banks that won’t lend to certain clients, the microfinance arm services this market segment which is under-served by the commercial banks and needs access to financing to carry out their business. Those clients aren’t limited to retail customers only but also to micro and small businesses as well. These loans based on the expected credit losses and receivables profile are usually current and within the 3 month time-frame with less than 2% of loans surpassing that time-frame which indicates that most of these loans are performing and not impaired.

Lasco Pay

Lasco Pay is the company’s newest service which is the introduction of a prepaid MasterCard which also has the E-Pay affiliation. This product is aimed at seizing the market space of clients without formal banking service and are paid mainly in cash. With numerous persons still without bank accounts and the largest commercial bank still not offering a visa/MasterCard debit card, this product gives LASF the opportunity to tap into this under-served market space. At the 2019 AGM, the Honorable Lascelles Chin highlighted that they plan to integrate the card with their Lasco Distributors (LASD) arm where many of the merchants and other service providers pay their employees and LASD through cash which is a bigger risk for the affiliate and regular persons. This service attracts a monthly maintenance fee of $200 and has other fees attached to bill payments as well. Most payments made through a point of sale terminal, E-Pay terminal and online transactions are free. They have also partnered with Wi-Pay to offer more payment solutions to clients with their prepaid card. This leaves the company with a relatively stable source of income and a new client market to tap into for the financial services market. The company also offers bill payment and top ups for various services such as JUTC cards at their outlets. The contribution of this segment is unknown, but it is less than likely material to the group.

Balance Sheet Analysis

The company has been expanding its asset base which has seen it grow from $313.7 Million in 2011 to $3.9 Billion at the end of 2019. This has been primarily as a result of cash and cash equivalents, receivables and intangible assets. The primary component of its receivables has been through loans given to clients for their needs. The asset base really grew in 2018 mainly due to the 100% acquisition of CrediScotia which contributed a significant amount to their balance sheet growth.

LASF’s liabilities have mainly remained much lower over the years up to 2017 just before the CrediScotia Acquisition. The CrediScotia acquisition saw the company issue a $1.46 Billion bond which was used to purchase the company from Scotia Group. The remainder of the liabilities have not truly grown, excluding taxation, which has gone up due to the company transitioning to the 50% tax remission.

Cash Flow Analysis

The company has had a relatively unstable cash flow from operating activities due to the way in which the company is structured especially in relation its loan business. In highlighting this instability, the company saw its cash flow from operations drop from $170 Million to $2.1 Million between 2015 – 2016 while there was a major shift from 2017 to 2019 with positive cash flow at $208.7 Million and a negative cash flow of $183.8 Million in 2019. The company has spent more on Property, Plant and Equipment, in addition to the sale of some properties for the investing activities which has seen it being mainly negative from 2011 – 2019. Cash flow from financing activities stemmed mainly dividends being paid out up to 2016, before the company started taking out debt which saw this segment remaining positive for the last 3 years. The acquisition of CrediScotia in 2017 was the primary reason the cash flow from financing was so high in that period.

Industry Analysis

Remittance

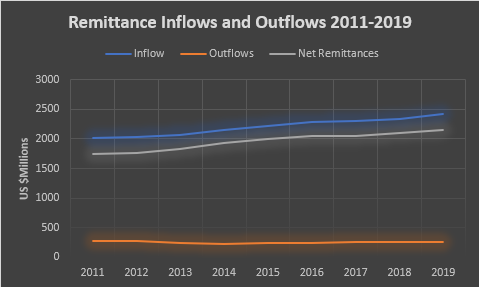

LASF operates in the financial services space which is primarily regulated by the BOJ. They mainly operate in the remittance space which has been growing for decades. With many Jamaicans going to greener pastures by migration, remittance inflows have been a stable supporting arm for the Jamaican economy as persons use it to carry out their daily needs. As highlighted by BOJ data, $2.415 Billion USD was sent to Jamaica in the form of inflows with only $262.8 Million going out as inflows. This income from other markets currently makes up 16% of Jamaica’s overall GDP just to highlight how significant the foreign inflow is to Jamaica. LASF operates as the number 2 firm just behind GK in terms of processing these payments. Even GK’s money services division has a high profit margin to highlight the opportunity which exists in the space. There are 425 locations in Jamaica with 666 licenses issued to those remittance providers. LASF has over 140 agents in their MoneyGram network just to highlight the size of the company and its reach in Jamaica.

However, the industry has been facing derisking concerns from local commercial banks and being forced to become more stringent from their remittance partners (MoneyGram and WU). As GK highlighted in their annual report, they had a lower transaction volume due to these same needs for more stringent measures as stipulated by their international partner. Even LASF had to turn back some clients and be much more stringent after MoneyGram’s $125 Million USD fine from the US Justice Department. To this end, they were able to renegotiate their exclusive partner agreement with MoneyGram and were able to partner with Ria Money Transfer in 2019. This problem is not only unique to LASF since Jamaica is considered a high risk country after the problem years ago regarding scamming and fraud. Even with more heightened measures, the overall industry on a whole has suffered as a result of the US departments coming down harder on banks up there to be tougher on correspondent banks in other countries less, they face heavy fines. This has put remittance providers in a sticky position since they must now upgrade their risk framework and juggle the risk of being let go by their commercial banking partners.

WU’s disclosures in their 2019 Annual Report have also highlighted these risks facing the remittance industry on a whole and the possible results of a downturn. It should be noted that a significant amount of Money comes to the Latin American and Caribbean yearly in the form of remittances. Remittance providers losing their ability to service the market space would make it harder for persons in this region to access their remittances which they need to survive and carry out necessary business.

Microfinance

LASF operates in an extremely competitive space with several firms aiming to capture more market space with their loan products. Their balance sheet of $2.3 Billion in loans pales in comparison to Access Financial Services Limited which stands at $4.9 Billion but is higher than ISP Financial Services which stands at $643.6 Million. These are just the known balance sheets of the listed companies and doesn’t include the other members of the space. The industry faces a major constraint if the Microcredit Act (2019) is passed in its current form which would limit many of the activities of the current operators in the industry. The microfinance industry charges higher interest rates to compensate for the greater risk derived from lending to the consumers who can’t qualify for normal loans. Some operators have been accused of overcharging consumers which is what the Act is supposed to protect consumers. However, the act would significantly undermine the operations of some and hurt LASF as well by limiting their ability to expand their balance sheet of loans with new clients.

Market Analysis

The company was listed in October 2010 at $2.50 per share before having a 10:1 stock split in 2013. Thus, the IPO price can be considered as $0.25. However, the stock has rallied over the years from that initial price to $1.20 at the end of the 2014 FY with the stock reaching an all time high of $6.97 in August 2019. The stock reached a low of $1.97 per share in March 2019 amid the mass selloff. However, the stock has still returned significantly positive gains when one factors in the dividends of $0.1541 paid out since listing in 2010. The stock has a known free float of 13.5668% which is not controlled by unit trusts, the top 10 shareholders, directors or executives which is better than some junior market companies. This means that there is about 172.3 million shares which are in the public’s hands which can be traded.

Q3 2019/2020 Analysis

LASF had one of its most disappointing quarters in recent history as higher expenses and finance costs consumed revenues while leaving net profit at $2.2 Million which was a 98% decline from the $106.6 Million recorded in the prior year. The revenue for the quarter was up 3.8% to $619.9 Million with revenue for the 9 months up by 10.9% to $1.93 Billion. The significantly higher taxation for the quarter and 9 months was a major drag on the company’s net profit as it grew by 419% and 69% respectively. With a loss of $16.4 Million in the second quarter and a meager profit in the third quarter, the company will not be able to realize a very successful financial year.

Under the balance sheet, the company had assets totaling $4.1 Billion compared to $3.9 Billion in March 2019. This was mainly due to the sale of the investment property for $100 Million and $150 Million loan which saw the cash and cash equivalents grow from $282.8 Million to $418.9 Million. Their loan balance also grew from $2.37 Billion to $2.59 Billion over the same period. The total liabilities of the company increased by $156.1 Million to $2.5 Billion. This growth was primarily from an increase in taxation and loans for the company. The bank overdraft facility was clear at the end of the period. During the period, the total number of shares for the company increased by a value of $6.6 Million as employees exercised their share option plan to acquire more shares in the company.

Cash flow from operations was positive for the 9 months under review and stood at $102.3 Million compared to the $183.8 Million of cash outflow from operations recorded at the end of March 2019. Cash flow from investing activities was up to $77.8 Million which was due to the sale of the investment property. Cash flow from financing activities saw an outflow to the tune of $45 Million. Since the company started paying principal on its bond in February 2019 and took out a loan to support working capital, the cash flow from financing will be much higher for the company going forward.

Post Q3 Analysis

After the first Corona virus case was announced in Jamaica, there was a precipitous response by the Jamaican government to contain the spread of the virus. As a result, schools were closed and non-essential services were required to open for fewer hours as curfews were implemented. As highlighted in the Gleaner article, JN Money Services reported a 25% fall in inbound transactions for remittances for his company while Don Wehby reported that there was a fall between 5 – 10% for the largest remittance company in the country. This coincided with shutdown orders in New York, Cayman Islands and the United Kingdom. In the USA, there was another recorded weekly unemployment claims to the tune of 5 million people while the overall claims in 1 month had surpassed 22 million people. On April 14, the government of Jamaica announced a lockdown for the parish of St. Catherine which has a significant economic input for St. Andrew and the overall country at the time. Subsequently, there was a 14 day closure for the BPO sector as the case of Alorica resulted in a rise of community spread in the country. All these measures have left numerous persons without employment as highlighted by Tourism Minister The Most Honorable Edmund Bartlett who pointed out that only ¼ of the sector (40,000 persons) was still working in some capacity while another 120,00 persons were out of a job. With the drop in remittance inflows, tourism basically dead and the BPO sector temporarily closed, there will be a significant decline in foreign currency inflows into the country. All of these factors spell trouble as the BOJ, Fitch and the IMF believe Jamaica will contract between 3 – 6% in the current term before starting to possibly recover in 2021.

Current Advantages During COVID-19

The company will have lower administrative, selling and promotional expenses since there would be less staff needed at the office along with most major tours or planned events being cancelled for the near future.

Future Implications on Duration of COVID-19

Until a vaccine is available along with an effective containment of the virus to prevent a second wave, global economies will continue to struggle under quarantine orders as the supply and demand shocks inhibit growth from occurring within each nation. This spells trouble for LASF as remittances will continue to decrease from the primary sources amid tightening economic situations and the possible death of those providing the remittance income. Even if the world was to go back to business tomorrow, the damage has already been done with oil prices gone below $0 and numerous persons unemployed who will need their income more than ever now. With tourism and commercial activity effectively frozen, their cambio division will see a gradual decline in transactions as persons plus businesses aim to use the domestic currency and carry out those financial activities until there is a need to start utilizing more foreign currency. The loan division is effectively at a standstill since their target market has significantly reduced incomes or no employment at all after the major decline in revenue for businesses across the nation. This has further implications for existing loans on the books of the company, which will see more provisions for credit losses as persons attempt to renegotiate their loans or request a payment holiday to ease the burden of financial distress. As a result of all these compounding factors, the company may need to renegotiate with its bondholders concerning the payment of principal which just started in February 2019. Also, the shorter time frames the government announces along with parish lockdowns will impede the company’s ability to operate effectively during these times and still generate revenue. This is all occurring during LASF’s final 7 months with tax remission as a junior market company. Until the release of the company’s audited financials are released (due by May 30/July 14 depending on changing situation with COVID19 and JSE extensions).

Until next time, stay safe, maintain your distance and Tan Ah Yuh Yard as we try to flatten the curve with COVID-19. The next article will be on a main market company to be decided in the week. 2 companies whose audited financials which are scheduled to be released are Kremi and Portland JSX so stay tuned to jamstockex.com/news for those releases.

-DR

Note: This article is not intended to be investment advice or come off as a stated buy, hold or sell position against this company. David Rose is not a licensed Investment Advisor and neither is EveryMickle.com in the business of giving investment advice. This article is intended to provide oversight and information on a listed JSE company.