Sagicor Select Funds - A Prospectus Overview

Hey Guys, I promised a simplified overview of the Sagicor Select Funds Prospectus and so I’m delivering today. Assuming everything goes to plan then this should be in your inbox by the Monday of the week that the IPO opens. I figure 3 days is enough time for you to read this, do your research, speak to a licensed financial advisor for their opinion, and then buy in, if you’re so inclined.

As always I have to keep myself jail-free and remind you that I am NOT a licensed financial advisor, and this overview is NOT financial advice. Here’s the disclaimer.

Disclaimer: This is simply an overview of the Sagicor Select Funds Prospectus as interpreted and simplified by me. I have based this overview on information obtained from sources believed to be reliable, however I do not make any guarantees as to the accuracy or completeness of the information within this document. This overview may also contain opinions of the writer, note that these opinions are personal and do not reflect the thoughts, advice or direction of any external company or person other than the author. This overview is only for information purposes and should not be construed as a recommendation to purchase or sell shares in any company or offer. Any such decision should be based on your own analysis of the prospectus and advice from a licensed, certified financial adviser.

So, as always, the aim of this review is to break down and simplify the key information in the Sagicor Select Funds Prospectus so regular people who aren’t finance experts can read and have an understanding of what the offer is.

This however is NOT a substitute for reading the prospectus. Always read the prospectus. The prospectus is the company’s official agreement with you. It is legally binding and lays out the company’s expectations and the offer to you. It is the official document from them, this review isn’t. The prospectus can be found here [LINK]

So, let’s begin. As I’ve said before, these overviews are written with beginners and regular people in mind, I deliberately avoid using too many technical terms so as not to have anyone feeling left out. For this prospectus though, you will have to know what an Index Fund is in order to understand this fully. I’ve written a simple beginner explanation article telling what an Index Fund is. Give it a read if you don’t know and come back here afterwards. Trust me, it’s worth understanding. [LINK]

What Is Sagicor Select Funds Limited?

Sagicor Select Funds (SSF) is a Jamaican company that was set up to buy, sell and hold financial instruments that are offered for sale on stock exchanges. That’s a fancy way of saying that the company was built to pretty much hold and manage groups of stocks bought using shareholder money. The exact wording from the prospectus however, leaves room for them to do other things in future, so I thought it best to make that clear from the jump. SSF intends to hold these shares in different groups, these groups are called “funds”. Currently they are IPO-ing (not a real word, but doesn’t it work so well?!) with just 1 fund, the Financial Select Fund (FSF).

Now, I assume that you’ve read the link above where Index Funds are explained. If you haven’t and aren’t quite sure what they are, I’m suggesting again that you read that article to gain a fuller understanding. I even used it as my Observer column this week so I’ll link to it again. Please read it. [LINK]

What Do They Actually Do?

So SSF holds and manages stocks in funds that they have created using money from shareholders. Their only fund currently, the Financial Select Fund (FSF), was set up with the objective to match the returns of JSE’s Financial Index, which was set up in March 1, 2019. This is intended to be what they call a “passive” fund. This means that once it’s set up, they don’t need to do much management of it. They simply leave the stocks as they are (minus any buying or selling that may be necessary to re-balance the fund to match the Index, which as I see it, shouldn’t be much, if any at all), collect any dividends, and pay them over to shareholders (after fees). That’s pretty much it.

A simple explanation of a “passive fund” is that a passive fund is like betting on every horse in a race. You’re definitely going to win, and as long as the winnings are larger than the cost of the losing bets, you’ll make money. It requires zero skill, which is the point. There’s an old saying that “the market always moves up in the long term”, which I mentioned in the Index Fund Explanation article. This Financial Fund is set up to take advantage of that, and as we see, if the Fund had existed on March 1, 2019, it would have gone up 24.4% in value by now, at the end of June 2019.

The JSE’s Financial Index as of June 28, 2019

So is the Financial Select Fund (FSF) an Index Fund?

The Financial Select Fund is what SSF is calling a ‘Listed Equity Fund”. They are very careful to never say that it’s an Index Fund, but the description they give very obviously shows that it’s meant to be an Index Fund. I think they stop short of calling it that though to not legally trap themselves into having to treat it as a true Index Fund.

Think of this like someone saying they need a ride from Half-Way Tree, to UWI. You’re passing by and offer to carry them, “up Hope Road to a point of my choosing at or close to Papine”. That’s pretty much UWI, but once you don’t say “ok I’ll carry you to UWI, you have the freedom of changing your mind or driving wherever you want. In the same way the language they use in a prospectus is very deliberate because it is a legally binding document from the company to the public.

Now is this careful language a cause for concern? Probably not, but I think it’s important that we all understand that as we go into this overview. Especially as the Financial Select Fund (FSF) is key to understanding what SSF does and how they plan earn money currently. They also use this careful language in speaking about how they plan to set up the fund, saying that they will purchase “substantially all” of the companies listed on the JSE’s Financial Index. This means that if they decide it’s unnecessary, they may not actually purchase everything, just the major stocks on the Index that they decide are needed.

How Do They Earn/Spend Money?

The Fund expects to receive money from 3 main things;

1. Dividend payments from the stocks they hold.

NCB pays out a quarterly dividend? That cash goes to the Fund

2. Money received from selling stocks.

Rebalancing the index and selling any extra stocks? The money from the stocks sold count as revenue.

3. The rise in share price of stocks held by the fund.

Bought NCB shares at $142.75 per share and the price on them is now $189.52? The difference between those 2 prices ($189.52-$142.75=$46.77 per share) counts as revenue.

That last one is expected to be the main driver of revenue as the FSF will tracking the Financial Index monthly and the objective of the Fund is to have its overall value match the value of the JSE’s Financial Index.

Anything Else We Should Know About the Fund?

It is very important that we understand what the Fund is aiming to do and what “returns matching the value of the JSE’s index” really means. SSF will have 2 prices associated with it.

1. The value of all the stocks the Fund holds. This is sometimes called the Net Asset Value (NAV) or the Book Value. It’s the total value of all the stocks held in the fund (based on end-of day stock prices), minus any liabilities SSF may have (debt etc.), divided by the Fund’s share count. This number will be shared by SSF and JSE on their respective websites as a tracking number.

(e.g. At the end of May 2019 we estimated SSF’s portfolio to have a NAV of roughly J$1.63B, which would mean each share has a NAV of roughly J$1.48. If nothing has changed in June, and the IPO happens with them taking in $4B, then that would mean the Fund would be worth J$5.63B and each share would have a NAV of $1.10, which is 10% more than they are being offered for in this IPO 👍🏾)

2. The price of an SFF share. This is the day-to-day trading price of SSF shares and it will move up or down based on what price shareholders choose to buy/sell at. This is the price you’ll see on JSE’s trading screens every day.

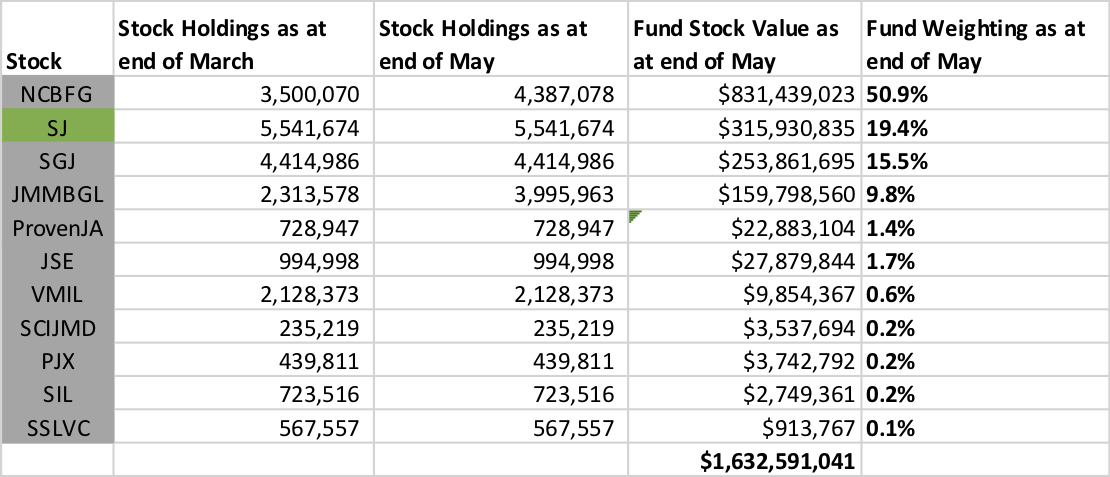

The Financial Select Fund’s Stock Holdings at the end of March and May 2019

Note that while the NAV represents the internal value of the Fund’s holdings, it does NOT represent how much each SSF share costs. The 2 numbers are separate and while SSF has stated that they hope that SSF’s share price matches the NAV, they cannot guarantee that it will. What they can do is work to ensure that the NAV of the Fund matches the JSE’s Financial Index. This means that there could be a situation where 1 SSF share could be worth $3 in terms of NAV but being sold on the JSE for $1.50.

Simple way to remember all this? SSF controls the NAV while the general trading public (you and me) controls SSF’s share price.

There is a similar situation like that with a different fund on the JSE, Mayberry Jamaica Equities. On June 24th, MJE’s NAV was $14.52 but MJE shares were available for sale at $11.22. In accounting terms this would be seen as a deal as you would be buying an asset technically worth $14.52 at a 22% discount.

In real life however, there is no guarantee that the share price will meet or exceed the NAV. It often does, and in a perfect world it should, but we don’t live in a perfect world, so just bear this in mind when considering SSF shares.

Who Owns SSF & What’s the Offer to the Public?

Currently SSF is owned by 2 shareholders;

Sagicor Investments Limited, which owns 1 Golden Share (called a Class A share in the prospectus) which is need to manage the company and administer the Fund.

Sagicor’s Sigma Fund, which owns 1.1 billion shares (called Class B shares in the prospectus) which they paid J$1.1 billion for. That money was used to buy the initial shares which currently make up the Fund.

Sagicor Select Funds Ownership Pre- Listing

The different classes of shares are being used to separate the ownership of each fund. Currently only one Fund exists and so the Class B shares cover that. The prospectus shows however, that the company has been set up to have Class B, C, D & E shares also, which likely indicates other funds which will be set up in future.

The same price that Sigma got their Class B shares for is being offered to the public in this IPO; $1 per share, for 2.5 billion additional shares in SSF. They are also reserving the right to issue an extra 1.5 billion shares at $1 each if there is enough market demand. In my opinion, this is very likely to happen.

That would bring the company’s total Class B share count to 5.1 billion shares.

Sagicor Select Fund’s Proposed Ownership Post-Listing

The minimum amount that can be bought is 1000 shares and any amount over that has to be bought in blocks of 1000. There is also the usual J$163.10 processing fee for the application. This means that for the regular person the minimum amount required to buy into this IPO is J$1,163.10. It doesn’t get much cheaper than that.

What Do They Plan To Do With The Money?

They have stated that they intend to use money received from the IPO to cover the IPO’s expenses (J$40M) and the remainder to buy shares on the JSE in order to fill out the Financial Select Fund fully and have it properly match the JSE’s Financial Index. Of note too, is the fact that they aren’t waiting to fill out the fund. By the end of May 2019 they had purchased an additional 887,008 NCBFG shares and 1,642,385 JMMBGL shares. I am not sure where the money to purchase these shares came from, but I’m sure we’ll hear in time. They have stated that they plan to purchase the remaining shares to complete the Fund by the end of 2019.

When Does the Offer Open?

The offer opens on Wednesday July 3rd, 2019 at 9:00am, and is slated to close at 4:30pm on July 17th 2019. SSF also reserves the right to close the offer anytime within that period if they get enough money or extend the offer period if they wish. While some IPOs get heavy traction from before they open and so they close almost immediately, I suspect that this one will remain open for at least a week if not the whole time. I personally think it will have heavy traction, but I also think Sagicor will leave it open in order to get as many participants as possible. I could be wrong of course, and this is all guesswork so my advice would be to apply from before July 3rd in order to secure your application.

Any Bonus?

Yup! SSF has included in its offer, 2 sets of 500 million shares reserved for;

1. People who have money in Sagicor Sigma Funds up to May 31, 2019.

2. Employees of the Sagicor Group of Companies.

Both of those groups of Reserve Shares are being offered at 98c each. That means that on Day 1 anyone who qualified for and bought those shares at that price would immediately start out with 2% profit.

If the Reserve Shares are not fully taken up by the people who qualify for them, then the remaining shares will be offered to the public at $1 each.

Dividends?

SSF has stated that they plan to pay out 90% of the cash that they have on hand at any given quarter as a dividend to shareholders (after covering fees and expenses). The cash on hand is expected to mainly come from dividends paid by the stocks in the fund which on average are expected to be about 2% of the Fund’s NAV annually.

Pros and Cons of this Offer?

I’ll lay these out as I see them personally here. Do remember, again, that this is NOT financial advice, speak to a licensed financial broker before you invest. This is also far from a comprehensive list, the experts will have lots of textbook pros and cons, but these are the ones applicable to regular people as far as I see.

Pros

Diversification of Risk. The FSF will allow purchasers to enjoy the benefits of fractional ownership in 23 stocks. This might be good, especially for people who may not be able to purchase the entire index on their own, or even some of the more higher cost stocks, like NCB, which currently required a minimum of roughly J$19,000 to buy into. That same amount in FSF would technically give greater asset ownership.

Long Term Price Appreciation. FSF is built on the principle that stocks always go up in the long term, moreover, Financial stocks are currently experiencing strong growth, led by NCBFG’s performance. This is a good sign for the Index as NCBFG is the heaviest weighting in it. As long as it continues to do well, the Fund’s value should rise. Between March 1st 2019 and June 28th 2019 the Financial Index rose by 24%. If you’re looking something to put your money in for the long term (years) then this isn’t the worst option out there. The GoJ has also started on its Financial Inclusion drive. This is designed to bring more people into the Financial Sector, which should mean good things for listed Financial companies, and of course, this index.

Cons

The Weighting. The FSF will aim to match the weighting of the Financial Index. NCBFG is almost 40% of this and the top 3 companies on the Index are over 70% of the Index’s weighting. Anyone looking for real benefit from Financial stocks may be much better off simply buying stocks in NCB, Sagicor and Scotia.

The Fees. SSF’s Financial Select Fund will be passively managed but there are still management fees to consider. Starting Jan 2020 0.5% of the total fund’s value will be taken as a fee by Sagicor. The fee may sound small, but buying these stocks on your own literally removes that extra fee and any other fees that may arise in future.

Partial Dividends. While SSF states that they intend to pay out “90% of the cash value of the fund” in dividends, this is after all fees and expenses are handled, so if NCBFG pays a quarterly dividend, that goes to SSF, then fees come out, then the rest is tallied up, and 90% of whatever is left is sent to you as a shareholder. Again, this can simply be avoided by buying the stocks in the Index directly. You get your full dividend payment, with no middle-man taking a piece.

No Portfolio Expertise. This is the downside of the “passive management”. Buying the entire Index means that some companies, which may be better avoided while they go through trouble, are still in the fund. So any poor results from them drag down the Fund’s overall performance, even though they may have been obviously bad and easily avoided. A managed portfolio would immediately see those stocks avoided and the gains from the good companies not watered down.

What Do You Think Will Happen When It Lists?

Well, I can’t read the future, but based on my observations and the general response I’ve been hearing from people on the street along with Industry players, they really, really like Sagicor Select Funds. The idea of an Index Fund is so attractive to most brokerage houses and analysts that I am led to think that the demand will be high. The obvious downsides are being brushed aside in the excitement of the moment and little things that would raise questions (like there being no Financials more recent than February 2019 included in the Prospectus which came out 4 months later or the heavy weighting in 3 companies, which previously caused other funds to receive poor brokerage recommendations). This excitement to me, speaks to a heavier demand, so I expect the offer to be very quickly subscribed and the full 4 billion shares taken up. Pensions especially are likely to flock to the offer and they come with heavy money and long timelines, which could mean that 4 billion units still wont be enough for the demand.

The offer price of $1 is also so psychologically attractive to typical industry players, along with the NAV being higher than $1, that I think that there will be enough post-listing demand to raise the price further. Again, this is NOT buy advice, but it is what I think will happen post listing. I could be very, very wrong, so check with a licensed financial advisor to hear their thoughts before acting.

Last Lick

While I was writing this piece, I came across a lady in a coffee shop and we got to talking. Turns out she’s a Wealth Manager with Sagicor Investments. In the event that you need to speak to someone qualified (like I have been saying again and again 😬) give her a call. She can not only help guide and explain anything further about the offer to you, but she can also handle your application from start to finish.

Her contact details are below. Give her a call and let her know you got her number from Randy, she’s a great lady, she deserves the business.

Ava-Marie Bigby-Edmond

Sagicor Investments Wealth Advisor

876-733-8317 (Office)

876-997-7450 (Mobile)

Good luck to everyone who participates in this offer. Here’s to keeping the gains high for the last half of 2019.