David's Data: Dividends and You; What Will Happen with The BOJ's Request?

Hello, everyone! Here is the latest installment in the David’s Data series. With the BOJ’s announcement of a suspension of dividends, what better time to talk about dividends than right now?

Leave any feedback you have in the comments below or you can send them directly to David at his Twitter account or at our own or email. Enjoy!

- The EveryMickle Team

What are dividends and what will happen with the BOJ’s Ruling?

With the Bank of Jamaica (the Central Bank) suspending the distribution dividends (cash or stock) for the Deposit Taking Institutions (DTI’s) and Financial Holding Companies (FHC) designated for the 2020 Financial Year (the BOJ Financial Year ends on December 31), it is time we delve into what dividends are and explore how shareholders/owners get paid from their subsidiaries.

“A dividend, in simple terms, can be defined as the payment of cash or stock from a company to the owners of that company’s shares/stocks.”

A dividend, in simple terms, can be defined as the payment of cash or stock to the owners of the company’s shares (stock). It involves certain elements for individuals and other elements for companies with subsidiaries. For an individual who buys a company’s stock on a stock exchange, there are 3 critical things one should observe. Let’s discuss these key elements using this example below of Scotia Group Jamaica (SGJ):

Scotia Group Jamaica Limited (SGJ) has advised that the Board of Directors approved an interim dividend of 51 cents and a special dividend of 74 cents per stock unit with respect to the third quarter, which is payable on October 23, 2019 to stockholders on record as at October 1, 2019. The ex-dividend date is September 30, 2019.

The first thing that should be noted is the types of dividend declared in this release. In this case, the interim dividend was 51 cents ($0.51). This means the dividend would be payable in the period. For SGJ, this is quarterly. If the release had said final dividend, then that would have been the final dividend for the financial year of the company. A special dividend of 74 cents ($0.74) was also declared which means this dividend is not a typical one and should not be expected to be declared again in the following period.

The next key element would be the payment amount or conditions of the dividend. In this case, the total dividend per share to be distributed amounts to $1.25. Thus, for every share you own, you would receive $1.25 JMD before any taxes are applied.

The final element would be the dates mentioned in the release which would be the ex-dividend date, record date and payment date. The ex-dividend date represents the day where you would have already needed to purchase the stock in order to fall on the record date. The record date refers to the day where all persons (stockholders) on the company’s register at that date would have been eligible to receive the dividend payment for each share at that time. The payment date is the day on which the net amount of the payment will be disbursed to shareholders bank accounts or mailing address with the cheque inside.

If you bought 10,000 units of SGJ under the Transaction + 2 business days (T+2) settlement system on Friday, September 27, then you would be on record for October 1 and would be paid $12,500.00 gross before taxes. If you bought the same number of units on Monday, September 30, the person who sold the stock to you would receive the dividend payment.

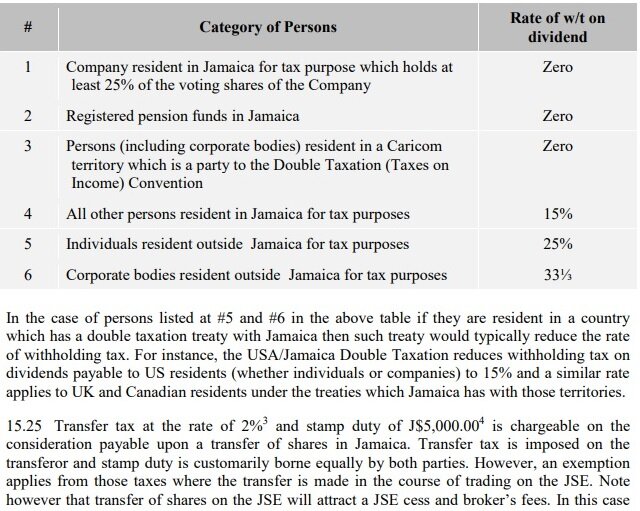

Even though we don’t pay capital gains taxes in Jamaica, we can be liable for withholding tax on those dividends. Despite the tax being removed completely in 2002, it was reintroduced during 2009 at 25% for individuals before being reduced to 15% in 2013 for Jamaican residents.

An excerpt showing the categories of persons that can receive dividends in Jamaica and their individual tax rates

Thus, if you were a Jamaican resident when you bought those SGJ shares, you would receive $10,625.00 as your net payout after the 15% withholding tax was removed. If you were a Trinidadian citizen residing in Trinidad, you would receive the full $12,500.00 payout due to the CARICOM Double Taxation Convention.

However, if you’re under the income tax free threshold, you can always claim back on the tax withheld on those dividends from Tax Administration Jamaica up to 6 years later with the IT05 tax form. Refer to this tweet and consult your tax expert for more details.

Some companies have been paying dividends for years to shareholders at a consistent rate. In the case of SGJ, they have paid in total $22.94 per share since July 2007 up to April 2020. Under the assumption one bought Scotia Group Jamaica on May 1, 2007 at $22.10 and ignoring taxes, the dividends alone would have paid for the stock itself over the span of 13 years before factoring in any capital gains (change in price of the stock).

“The ability for a company to pay a dividend every quarter comes down mainly to cashflow and how fast a company can generate it during each quarter.”

Before COVID19, there were a set of companies on the JSE which always paid a dividend every quarter to their shareholders. These included NCB Financial Group Limited, Scotia Group Jamaica Limited, Carreras Limited, Supreme Ventures Limited, Gracekennedy Limited, Panjam Investments Limited, Proven Investments Limited, Access Financial Services Limited and Eppley Limited. Newcomer to the market First Rock Capital Holdings Limited will also be aiming to pay a quarterly dividend as well to shareholders with Sygnus Credit Investments Limited not far behind. Also, Dolphin Cove Limited paid shareholders 3 times a year in dividend payments as well. The ability for a company to pay a dividend every quarter comes down mainly to cashflow and how fast a company can generate it during each quarter. Also, if the size of the dividend is smaller, then a company will opt for a semi-annual or annual payment to reduce expenses associated with paying that dividend.

In the table above, the dividends represent the payout by companies from their 2016 Financial Year up to the end of 2019. As seen above, Scotia Group has paid out the most in dividends for the last 3 years. The majority of that payout came in 2019 when they declared 2 special dividends totalling $2.68 per share. Most of the companies in this list are financial in nature, with PJAM in private equity and real estate, CAR being in consumer products and SVL in gaming. The reason behind these companies being able to pay out so much over the last 3 years comes down primarily to their dividend policy and stance on payouts. SGJ, CAR and SVL have an unofficial 100% payout policy as seen by their dividend payouts in the last 3 years which have seen almost all profits paid out to shareholders. It should be noted that SGJ and CAR have foreign owners who repatriate their profits through this 100% policy. These dividends go through a Caribbean subsidiary, which isn’t subjected to withholding tax before going to the parent company in the respective countries. SVL, as a gaming company, pays out most of what their clientele bet on their games. With sufficient capital generation for internal expansion, this policy suits the majority shareholders and the minority shareholders by extension. PJAM’s dividend payout depends a lot on their new ventures, disposal of securities and dividends from SJ. They are a consistent company and should maintain a relatively high payout ratio of around 20%. NCBFG has a 50% dividend policy. This means they intend to pay up to 50% of their net profits to shareholders in the form of dividends. As the company has generated more income, the dividends have increased as well. SJ has had a dividend payout ratio above 30% for the last 5+ years as their banking, investment and insurance arms grew rapidly. GK has a 20% dividend policy and has only recently started to pay dividends every quarter to shareholders as they expand their reach in the world.

PROVEN has been the highest consistent USD dividend paying company on the JSE since the USD Market was established in 2011. Even though the company has a 50% dividend policy, they have managed to pay shareholders consistent dividends while continuing to expand their reach. The big reason for the uptick in dividends came as a result of the partial sale in Access Financial Services and their higher income generation from their various subsidiaries. JPS’s ordinary shares are not listed on the JSE as yet, but they have paid $10 Million USD in each of the last 2 FY’s with roughly 20% of those dividends going to the Government of Jamaica while the remaining 80% is split between the Korean and Japanese owners. JPS’ preference shares have paid out consistently, but those aren’t really liquid while the ordinary share payments have become more stable in the last few years. Express Catering Limited is another example of a company with profit repatriation since the majority of those dividends ($7 Million) was paid following their IPO. These proceeds went to Margaritaville St. Lucia which then went to the parent company in the Bahamas. MTL also has the same Bahamian owner and has paid dividends as the operating environment permitted. They didn’t pay a dividend during their 2018 FY after the hurricane caused significant damage to the port of operations. KPREIT has consistently aimed to pay a dividend which was more than 50% of earnings. This is well below their 90% stipulated dividend policy. MPCCEL is a new company which paid its first dividend last year. PBS has had unstable profits which is a major reason why their dividend payouts haven’t been consistent with the last dividend being paid in 2019.

How do Financial Holding Companies pay dividends to shareholders?

When you read the consolidated financial statements of a company, you’re reading the results of all the companies which make up the group (parent company and subsidiaries). However, each Financial Holding Company (FHC) is actually a stand alone registered company which doesn’t have core operations in order to truly generate income. As a result, they receive dividend income from their subsidiaries and receive management fees from agreements with companies within the organization. These line items along with changes to cash flow can support the payment of dividends to shareholders of the listed company. We will examine 3 companies to get a sense of how the money flows from point A (subsidiaries) to point B (parent).

Sagicor Group Jamaica

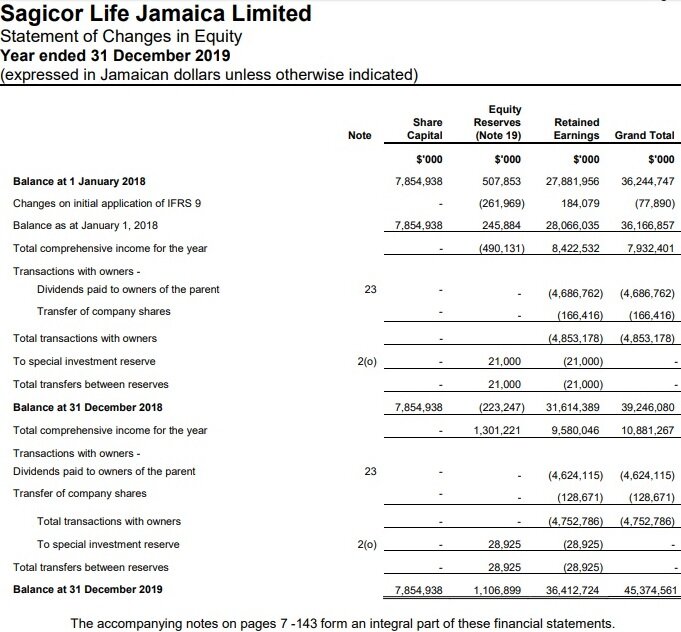

On page 9 of the 2019 Audited Financials (December 31, 2019) which shows the Company Statement of Comprehensive Income, one notices Investment Income of $6.7 Billion and Management Fees of $304.8 Million. After expenses are factored in and other calculations are done, a net profit of $5.577 Billion is realized and $5.579 Billion in Total Comprehensive Income. Under the Statement of Changes in Equity on page 10, one notices a dividend of $5.624 Billion paid in dividends to shareholders for 2019. How can the company pay more in dividends than it earned for the period? This is where the cash flow statement comes into play. As one looks at the cash and cash equivalents for the year, one notices that the company had $947.33 Million in cash and cash equivalents at the start of the year which made up for the greater dividend pay out.

When one investigates Management Fees, note 1(c) explains that this comes from shared services. Investment Income under note 42 on page 117 shows that dividend income was $6.62 Billion. This dividend income didn’t come from listed companies, but from their subsidiary companies instead.

Under the 2019 Audited Financials of Sagicor Life Jamaica Limited on page 5, Sagicor Life Jamaica Limited paid out $4.624 Billion to Sagicor Group Jamaica which was recorded as dividends paid to owners of the parent. This leaves $2 Billion in dividends to be accounted from the subsidiaries.

As highlighted from Sagicor Bank’s Audited Financials from 2018 and notices on the JSE, Sagicor Bank Jamaica has paid out $1 Billion in dividends in each of the last 2 Financial Year’s to Sagicor Group Jamaica. This has come in the form of dividend payments in May and December where $500 Million is paid out each time. If this policy of $1 Billion each year had been retained for the current year, only $1 Billion would be left outstanding for that 2019 payout.

On page 50 of the segment analysis for Sagicor Group’s Audited Financials, Investment Banking is highlighted as the only other segment which could have generated that dividend payout of $1 Billion. Although the financials for Sagicor Investments Limited aren’t publicly available, it is safe to assume that this segment would have provided the $1 Billion payment to Sagicor Group Jamaica. Thus, one sees where the majority of this investment income (specifically dividend payments) comes from to pay shareholders their dividends.

When Sagicor Group pays their dividends out to shareholders, 49.11% of those dividends go back to the parent company which is Sagicor Financial Company Limited. All of these connections show how money flows from the DTI (Sagicor Bank) and other subsidiaries up to the parent company and its shareholders. Thus, even if the BOJ only restricted Sagicor Bank in paying dividends, Sagicor Life and Investments could have supported the Group in paying dividends for the rest of the year.

NCB Financial Group Limited

In this twitter thread, I broke down how NCB Financial Group (NCBFG) got its money to pay out shareholders for their financial year. Of the $9.72 Billion in dividend income NCBFG received from their primary subsidiaries in FY 2019 (September 30, 2019), $8.44 Billion of these dividends came from NCB Jamaica Limited which is the commercial bank based in Jamaica. The rest of the dividends came from Guardian Holding Limited in Trinidad. Clarien Bank Limited has not paid a dividend since NCBFG acquired them in 2017. Under the NCB Jamaica (NCBJ) financials, they in turn received $11.31 Billion in dividends from their subsidiaries which included NCB Capital Markets Limited, NCB Insurance Company and their subsidiaries. Thus, the trail of income from NCBJ’s subsidiaries going all the way up to the parent company reveals how shareholders were paid their massive dividends in the 2019 FY. AIC (Barbados) would have received 52.46% of the dividends paid out by NCBFG during the 2019 FY and even in the 2020 FY. However, with the BOJ restricting the commercial banking arm and FHC’s, NCBFG would not be in a great position to pay out dividends to its shareholders since NCBJ is the direct subsidiary under the Group which supplies most of that dividend income. Guardian Holding had paid out a $1.47 Billion dividend to the Group in April, but it is unknown as to how many dividends were paid from NCBJ to the parent company.

JMMB Group Limited

JMMB Group Limited in their 2019 FY (March 31, 2019) as a company paid out $782.7 Million in dividends to shareholders of the company. When one looks at the company statement of income (page 182 of annual report), JMMBGL received $906 Million in dividends from its subsidiaries and had a net profit of $322.2 Million. Since JMMBGL is split up into 3 key umbrella’s with 2 separate subsidiaries plus an associate company under their ownership, movement of capital from the subsidiaries to the parent isn’t as straightforward as it might seem. Thus, we will look at one Jamaica Money Market Brokers Limited (JMMB), JMMB Bank and the associate relationship with Sagicor Financial Company Limited (SFC).

“JMMB Group Limited in their 2019 Financial Year…paid out $782.7 Million in dividends to shareholders of the company. ”

JMMB Bank Limited is a direct subsidiary under the JMMBGL Group and paid $100 Million in dividends to the parent company in 2019. Even though this was a decrease from the $300 Million paid in the prior year, this still was a high payout. JMMB is an umbrella of companies which includes JMMB Securities Limited, JMMB Insurance Brokers Limited and JMMB Fund Managers Limited. JMMB paid out $741.8 Million in dividends to JMMBGL during the 2019 FY which was a decrease from the $952.1 Million paid in the prior FY. With these relationships tracked, these dividends between JMMB Bank Limited and JMMB represented 93% of the dividends paid to JMMBGL. The remaining dividends could have come from JMMB Trinidad Limited or JMMB Holding Company.

In December 2019, JMMBGL acquired a 22.5% stake in SFC which represented 33,213,764 ordinary shares of the company. Since the company owns more than 20% but less than 50% of the shares in SFC, this company will be treated as an associate company. Since SFC was acquired by Alignvest Acquisition II Corporation, they have disclosed in their SEDAR filings that they intend to pay out annually $0.225 USD per share ($0.05625 quarterly) in dividends to shareholders. This would represent $7.47 Million USD in dividends for JMMBGL which at a rate of $140 -1 (JMD-USD exchange rate) would represent $1.05 Billion in dividends payable to the company. JMMBGL has already received $1.87 Million USD of these dividends and should be receiving that next $1.87 Million USD payment in May. With these factors considered, JMMBGL can still receive dividends from their associate companies and some subsidiaries, but would not pay dividends to shareholders of the company as stipulated by the BOJ directive.

All of these relationships highlight where the dividends of the FHC’s come from to pay shareholders and how restrictions on one can affect the holding company’s ability to pay dividends. The entire group of companies for the FHC’s can still generate profits as seen with SJ, NCBFG and JMMBGL’s $15 Billion, $30 Billion and $4 Billion in net profit for their respective financial year’s.

The BOJ’s announcement directly affects DTI’s as listed by the BOJ’s guidelines and the FHC’s which own them. The announcement didn’t affect investment banks like Mayberry Investments Limited or loan providers like Access Financial Services Limited. Thus, GK’s Financial Group arm is directly affected, but the overall GK group which also includes the Food division wasn’t affected. JN Bank which is owned by the JN Financial Group is a member owned entity and as a result wouldn’t be significantly affected since there is no dividend payment to shareholders. Regular JSE listed companies weren’t restricted by the BOJ’s stipulation excluding those FHC’s which are directly listed in regards to dividend payments.

“The BOJ’s announcement directly affects DTI’s as listed by the BOJ’s guidelines and the FHC’s which own them.”

With the BOJ’s announcement, shareholders should note that Panjam’s dividend payment plans for 2020 will be adjusted since the $472.1 Million dividend payment due in May is now thrown off schedule with Sagicor Group deferring the dividend payment to the unknown future. Also, Sagicor Select Funds Class B shares (Financial) are now significantly affected as well since the tax free dividend income they would gain to pay shareholders their dividends is now affected entirely. Even Proven Investments Limited which owns 20% of JMMBGL will not be able to book the dividends for this year as JMMBGL holds off on a further dividend payment as well. The JSE market even took a hit the week after the announcement as persons sold some securities to garner cash to tend to their business. Either way, it will be a rough time for everyone as the pension funds, unit trusts, listed companies, private investors and other companies which really on capital distributions from these big companies are affected by this halt in payments. Other listed companies may follow suit and suspend dividend payments altogether to preserve capital in the firm. Mayberry Investments Limited halved their dividend payout for this year from $0.25 in 2019 to $0.125 in 2020. Sagicor Group had also altered their dividend payout for the first quarter from $0.79 to $0.49 as well. This was the first fall off in more than 5 years of Sagicor Group’s first dividend payment for the start of each calendar year. With the European Central Bank and even UK Central Bank also stipulating the suspension of dividends, the BOJ’s move wasn’t unexpected as firms enter the unknown where companies and persons might go bankrupt. The best thing to do during these times is to revaluate your game plan and aim to understand which companies can survive the COVID19 storm and can come out stronger.

For those who would like for their dividends to be sent directly to their bank or brokerage account, you can fill out a mandate form and mail it to the JCSD on 40 Harbour Street, Kingston or return it to your broker. Here is the version for JMMB Securities Limited clients. If you select all, please note all dividends will go directly to the account you have chosen. This includes USD dividends as well. For the companies which pay USD dividends, it is best to fill out a second mandate form and put in the symbols of each company that pays USD dividends and put a USD account so that you get the USD directly. If you don’t do this, the dividends will be converted to JMD at the buy cash rate of whichever institution that you direct your dividends towards. Also, note that individuals who fall under the income tax free threshold ($1.5 million), can retroactively claim back on taxes withheld for up to six years by Tax Administration Jamaica (TAJ). This is done through the IT05 form and can be facilitated by a TAJ representative.

Until next time, stay safe, maintain your distance and #TanAhYuhYard as we try to flatten the COVID19 curve. Enjoy the next article and keep reading past releases.

-DR

Note: This article is not intended to be financial advice or come off as a stated buy, hold or sell position against this company. I am not a licensed financial advisor and this article is intended to provide oversight and information on a listed JSE company.